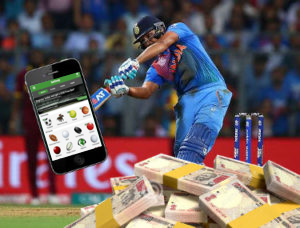

Online Betting App Ipl

There is a consensus of opinion that cricket may be the most loved sport in our nation. The game is more like one of the religions in the country as it brings people together and helps them forget their many differences, even if it is only for a short time.

The Indian Premier League (IPL) is a professional Twenty20 cricket league in India contested every year by teams representing different cities or states in India. The league came into existence in 2008 with 8 franchises. Since then, IPL has attracted some of the biggest cricketers from all across the globe. It has turned out to be the most watched T20 league in the world and has been a huge money spinner for the BCCI.

This betting app is a pacesetter in the eSports market. With an easy-to-use user interface, and games such as CS go and Dota 2, Pinnacle offers the IPL games for Android and iOS users. It also features some of the highest odds amongst similar apps, which is always helpful for amateurs. IPL Betting App One of the great attributes of the cricket betting tips displayed in this guide is that it can be universally applied across many other betting markets for IPL as well. Some of the top IPL cricket betting apps provide you with ample opportunities to place effective bets and start winning substantially as well. BetBarter is a trusted online gambling site in India offering sports with Ipl real money betting app, poker, bingo games, and betting on horse racing.Join Today to claim your welcome bonuses. IPL Betting App One of the great attributes of the cricket betting tips displayed in this guide is that it can be universally applied across many other betting markets for IPL as well. Some of the top IPL cricket.

While watching IPL with family or friends is an entertaining affair, IPL has definitely widened the scope of gambling. While, betting or gambling is illegal in India, there is no law that makes online betting an illegal activity. Offshore betting companies use this ‘loophole’ to lure Indians to bet on pretty much everything. The Indian Premier League (IPL) tops their lists and some websites have even hooked up with offshore betting agencies, thereby allowing Indians to place online bets.

In the past, betting on cricket was a pretty straight forward affair. One would go to their nearest bookies, place a bet, then watch the game, hoping the outcome would match the one you predicted. With the birth of the Internet and mobile apps such methods of gambling slowly disappeared in to history. Now what happens is that if one wants to bet on IPL games with real money, all they have to do is click on the link of the bookmaker they want to use.

They can then sign up with the bookmaker by opening an account with them. Then go to the cricket section of their website, where they will list all the IPL games that you can bet on and can choose which matches to bet on. Not only matches, one can bet on possibly every aspect of an IPL match, from the toss to how the bowlers will fare and the odds on a batsman scoring a hundred.

Is online betting legal in India?

According to the Public Gambling Act (1867), all kinds of gambling in India are illegal. But unlike in the US where there is the American Internet Gambling Prohibition Act, no specific laws exist in the Indian system that bar online gambling. Nowadays, online betting India is gaining huge popularity day by day due to its specific features that give you an amazing experience anytime and anywhere and also there is nothing mentioned about online betting in the Public Gambling Act, 1867.

The question of whether it is legal to bet from India using an international bookmaker is not clear in law. While bookmakers in India are illegal, there is no specific law in India which bans an individual customer from placing an online bet with a bookmaker based outside India.

How are winnings from betting taxed in India?

The provisions of income earned from online gaming fall under section 115BB of the Income Tax Act. This comes under the head ‘Income from Other Sources’ while filing income tax returns. It includes winnings from betting, gambling, card games or any other games. Hence, winnings from online gaming also fall under this category.

- In India the money you earn by betting or gambling is subject to income tax. Income earned from online gaming is considered as ‘Income from Other Sources’ while filing income tax returns (ITR) and it is taxed as per the provisions of the Income Tax Act.

- This income is taxed at a flat rate of 30% excluding cess without taking into account the basic exemption limit.

- The net rate after cess amounts to 31.2%, without the benefit of the basic exemption limit.

- For instance, an individual’s annual income is Rs 1.5 lakh and he has earned Rs 50,000 from online gaming, then his total income comes to Rs 2 lakh, which is below the basic exemption limit of Rs 2.5 lakh. But still the individual has to pay tax on the Rs 50,000 including cess. Further, no deduction or expenditure is allowed to be claimed against such income.

Is TDS required on be deducted on such earnings?

- The entity distributing the prize money is required to deduct TDS if the prize money exceeds Rs 10,000 @30%.

- It does not matter whether the income of the winner is taxable or not. The amount distributor is liable to deduct tax at the time of payment.

- Even if the entity distributing the prize money deducts TDS, the receiver is required to disclose this amount while filing his annual ITR.

- If the prize is received in kind, then tax will be applicable on the market value of the prize received in kind. The prize distributor in this case also needs to deduct TDS before transferring the prize to the winner.

Can one claim deductions against such earnings?

No deduction under section 80C or 80D or any other deduction/allowance is allowed from such income. The Benefit of basic exemption limit and income tax slab rate is also not applicable to this income. The entire amount received will be taxable at the flat rate of 30% + cess.

Bookies and online gambling companies are now focusing on and targeting young, impressionable people by looking for the next generation of potential addicts and ensuring the sustainability of a business model. Most try to lure punters into their web with the initial offer of a ‘free bet’. They will actually give you money to have your first crack and are sincerely hoping that you will get hooked on to it. Gambling is highly addictive, and ‘problem’ or ‘pathological’ gambling is a psychiatric disorder. It’s all about impulse control, and when the individual can no longer control the impulse to gamble, problems occur.

Online Betting App Ipl League

It also becomes difficult to catch internet gambling offenders if the websites are hosted by servers located in countries where betting is legal. Enforcing the act becomes difficult if the servers are located offshore. The legalization of betting would bring huge revenues to the government.

Ipl Betting Tips

On 4 March 2009, the Government of Sikkim (Finance, Revenue and Expenditure Department) issued a memorandum known as Sikkim Online Gaming (Regulation) Rules, 2009. This outlined the rules and regulations for online gambling licensing within that state. However, if an Indian resident decides to place bets on a website hosted outside the country, it would be difficult to hold him guilty of online gambling if the laws of the country where the website is hosted, permits online gambling. This is why India should enact a specific internet gambling law.